Should I agree to be paid as an independent contractor?

Question: I am making $15 per hour on the books working for XYZ Contracting. My boss proposed that he pay me as an independent contractor (sub-contractor, 1099 contractor) and he would give me a raise to $17. Should I accept his offer? ~Ed

Answer: Absolutely not!

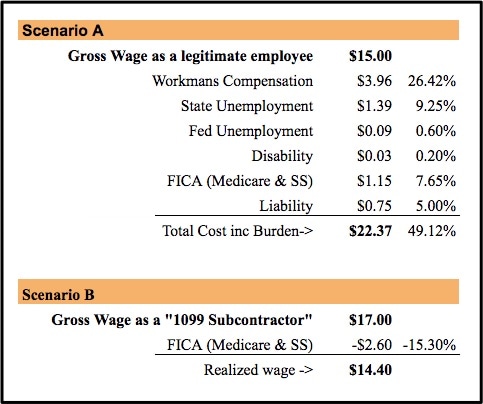

First let me explain why he wants to do this. In Scenario A, not only does he pay your $15 per hour but he also pays “labor burden”. In New York State labor burden is made up of Workmen’s Compensation insurance, Federal Unemployment, State Unemployment, Disability Insurance, Social Security, Medicare, and depending on the policyholder—Liability Insurance. For every $1 he pays you, he pays the government or an insurance company almost 50% more! So your $15 really is costing him $22.37 before he even thinks about paying for his overhead and then profit.

First let me explain why he wants to do this. In Scenario A, not only does he pay your $15 per hour but he also pays “labor burden”. In New York State labor burden is made up of Workmen’s Compensation insurance, Federal Unemployment, State Unemployment, Disability Insurance, Social Security, Medicare, and depending on the policyholder—Liability Insurance. For every $1 he pays you, he pays the government or an insurance company almost 50% more! So your $15 really is costing him $22.37 before he even thinks about paying for his overhead and then profit.

The math

In Scenario B, your employer pockets $5.37 while you actually make $.60 less than you did before the deal. To be at a (very loosely held) breakeven, you would need to make $17.75 just for the privilege of saving your employer a ton of money. The only way that I would ever consider being converted to independent contractor status would be if the wage was at least 50% more.

You still have to pay those burden items. The government does not allow you to not pay your Social Security and Medicare—even if you are self-employed. They want their 15.3% because they know that whether you’re on or off the books, they are going to end up paying for you when you’re old. In Scenario A, your employer is obligated to pay 7 1/2% of it for you. In Scenario B you are self-employed and therefore compelled to pay the whole thing yourself.

And how does the government compel you to pay it? Your employer will send them a 1099 report detailing everything that was paid to you. That way they get to take the full write off for your wages. You in turn, are obligated to pay on what was reported. It does not matter if he hands you green cash—if he also files a 1099 on your behalf then you owe the money.

There is also state and federal withholding. That money is at par. The only difference is that in Scenario A, your employer is responsible for holding your taxes and in Scenario B it is up to you. Again, even if he hands you green cash, you are still obligated to set aside (25%-40%) for your income taxes to be paid later on.

The not so obvious things

Not only will you lose money, but you also lose all of the very real benefits that “labor burden” is paying for. Workmen’s Comp is a big deal if you get hurt. As are Unemployment and Disability. Those are benefits that you are entitled to as an employee. Everyone wants a job with benefits—well the first tier of benefits are paid for and available to you just by being properly on the books.

When does being a subcontractor work in your favor?

Based solely on the math, your compensation should be about 40% more just to break even. Each situation is different, but I would say that if you have your own liability insurance, then your multiplier should be closer to 1.5% as a breakeven.

The elephant in the room

The elephant in the room is the IRS. The IRS says that if the situation looks, acts, or even has the feel of an employee-employer relationship, then it IS an employee-employer relationship and Scenario B would be illegal. Were it not illegal, then everybody would set their companies up this way and nobody would ever pay taxes or insurance 🙂

Conclusion

Many folks are tempted to agree to arrangements such as was proposed because maybe it feels better on the up front because your check is more money. The truth of it is that this is a very one sided offer and you would be foolish to take it.

I am in a similar situation. I am currently being paid $11 as an employee, and another job is offering $15 as a contractor. Should I accept this, or would I end up with the same amount of money? I am new to the entire contractor thing.

1). $15 minus the 15.2% that you ABSOLUTELY MUST pay on April 15 is equal to $13.32. So you’re starting there. 2). You still have to pay Federal and State income taxes, so you are responsible for setting that aside yourself. Technically you are supposed to make weekly (or at least quarterly) contributions as you get paid. The IRS is allowed to penalize you for not doing this. 3). You give up your Workmans Compensation insurance coverage and your unemployment insurance. 4). It probably would never happen, but you have no liability insurance either. Technically you’re representing yourself as an… Read more »

Nice write up John.

You are absolutely correct. Work as an Independent contractor is a very risky business. Also it is not a job class for construction. I think that the IRS will not go for it. Perhaps a subcontractor could get away with it but not a person who has been classified as an employee. That is a no no. Working off the books is for idiots and I know a few. A person working off the books is a nobody and can be completely ignored putting the burden of proof on the off the books worker. Working with no medical or insurance… Read more »

Great article John. From both the employee and employer perspective.

From an employee viewpoint, don’t underestimate the value of the unemployment, disability and worker’s comp insurance coverages. It is a frightening thing to get hurt or run out of work and not be covered.

From an employer viewpoint, this is why it makes sense to to have someone cover all those items for a temporary labor requirement…as compared to trying to hire someone, get them on the books and into your system.